Why Global Central Banks Are Buying Gold?

The third quarter of 2022 saw an increase in worldwide central banks’ gold purchases to 399.3 tons, up 115% sequentially and the greatest third-quarter level since 2000, according to the World Gold Council’s Global Gold Demand Trends report, which was published in November. Global central banks have bought 673 tons of gold so far this year, more than any full-year sum since 1967.

The prospect of a worldwide recession and excessive volatility in financial markets have presented investors with additional difficulties in the wake of the outbreak, the Russia-Ukraine conflict, high inflation in Europe and the United States, and interest rate hikes by central banks. Institutional investors have now focused on gold, including global central banks, sovereign funds, pension funds, and funds. Why are institutional investors and central banks buying gold? What role does gold play for domestic investors?

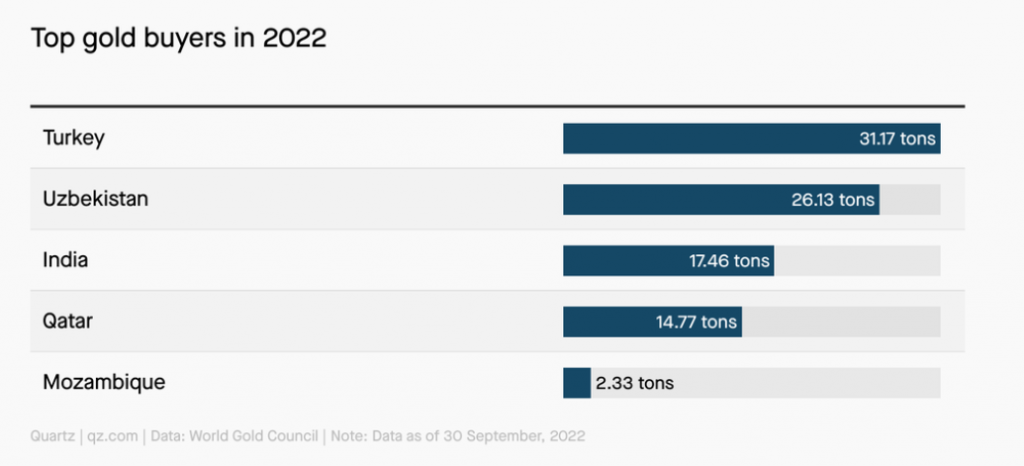

A survey conducted by the World Gold Council and released in June of this year indicates that central banks throughout the world will favor gold as a reserve asset in 2022. Of the 56 central banks questioned, 25% indicated that they would increase their gold holdings in 2022, compared to only 8% in 2019.In terms of trends in global gold demand, several central banks from emerging markets are the most active buyers of gold in addition to total gold purchases rising. The poll revealed that Uzbekistan’s central bank continued to build up its gold reserves, purchasing 26 tons of gold in the third quarter, making Turkey the greatest “gold buyer” this year with 31 tons of gold purchased in the third quarter. Year to date, gold holdings have climbed by 95 tons.The Reserve Bank of India also continued its long-term gold buying plan in the third quarter, buying a total of 13 tons in July and 4 tons in September, elevating it to the position of one of the most significant “gold purchasers” in the world.

Gold is one of the top-performing investments this year

Uncertainty abounds in 2022. Major risk assets have been adversely affected by a number of factors, including the outbreak of the Russia-Ukraine conflict early in the year, the start of a rapid rate-hike cycle by central banks like the Federal Reserve, the threat of high inflation, and the recession that has deeply troubled most countries.

Mainstream domestic assets have not done as well as they could have due to persistent epidemic pressure on the economy, a slowing real estate market, and growing spreads with big markets like the U.S. The price of gold, which is denominated in RMB, has increased by 8% so far this year due to a number of factors, exceeding traditional assets.

Which central banks will buy gold?

According to World Gold Council data, the third quarter of 2022 saw a significant increase in central bank gold purchases, reaching about 400 tons, the highest quarterly total since 2000. Turkey, Uzbekistan, Qatar, India, and other central banks of these developing nations are among the top purchasers.

According to the data, Turkey is this year’s top gold buyer. Turkey increased its gold holdings to 489 tons in the third quarter of this year by purchasing 31 tons of gold. Turkey’s gold holdings have climbed by 95 tons so far this year.

The central bank of Uzbekistan also added to its gold holdings this year, purchasing 26 tons of gold in the third quarter. Over the last two quarters, the nation’s central bank has likewise continuously purchased gold, with net purchases totaling 28 tons so far this year.

Another notable gold buyer in the third quarter was Qatar’s central bank, which purchased 15 tons of gold in July, the largest monthly purchase in the bank’s history.

The Reserve Bank of India continues to purchase gold in the third quarter, which is not unusual. India’s gold reserves increased to 785 tons thanks to purchases of 13 tons in July and 4 tons in September.

How can gold withstand currency depreciation?

Non-U.S. currencies: significant depreciation in a strong dollar environment

So far this year, most non-U.S. currencies around the world have depreciated significantly in the face of an extremely strong U.S. dollar. Gold denominated in most non-U.S. currencies has gained nicely as the decline in national currencies far outweighs the decline in dollar-denominated gold.

Local currency denominated gold: a hedge against currency devaluation risk

With major global risk assets and currencies falling sharply, gold denominated in each country’s local currency was one of the few assets that performed solidly. This is where gold’s protection against the risk of currency devaluation comes into play.

Russia-Ukraine Conflict: Gold without Political Risk in the Spotlight

Following the crisis between Russia and Ukraine, Europe and the United States put a freeze on the Russian central bank’s foreign exchange holdings. This is the first time in modern international relations that a country’s foreign exchange reserves have been sanctioned for purely political reasons. Gold is the only asset free of political risk, thus central banks are paying more attention to it as they consider increasing the diversification of their reserve assets when an extreme danger materializes.

What “Gold+” means for investors?

In the midst of continued global danger and uncertainty, gold+ remains valuable.

Given the lingering uncertainties over future economic growth and currency rates, the rising risks of global stagflation, and the unavoidable geopolitical unrest, RMB gold’s relative robustness and moderate volatility can offer domestic asset portfolios a margin of safety. As a result, investors may be better able to control risk and returns thanks to gold’s strategic place in asset portfolios. For investors, “gold+” will become even more significant.