What You Need to Know about Hot Money

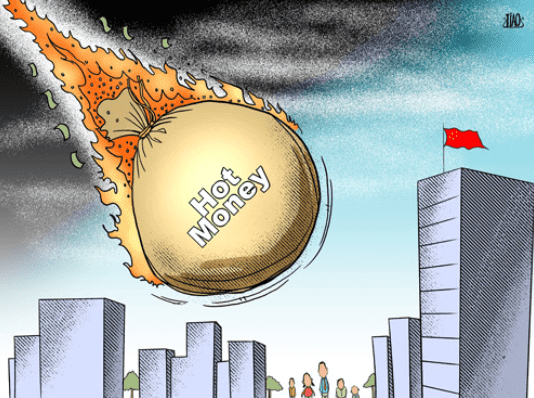

I believe that many investors have heard of hot money when they invest. Whether it is buying stocks, funds or stock indexes, hot money exists. At the same time, the term hot money often appears in financial news, such as where the hot money flows into and where the hot money flows out. The term hot money seems to have flooded the entire stock market, so what exactly hot money means, this article will tell you in detail.

Understanding the Hot Money

Hot money refers to money with a fast inflow of funds. Fund inflow speed refers to the amount of capital inflow per second. What is commonly referred to as hot money refers to large amounts of circulating short-term capital, including both international short-term capital and medium- and long-term capital. To be more specific, the purpose of hot money is purely for speculative profit, not for investing in industries, creating jobs, or providing goods or services. This is also the biggest difference between hot money and investment.

In the business dictionary, hot money is defined as highly liquid short-term capital that can quickly flow to any country that can provide better returns. At this stage, the objects of hot money speculation generally include: stocks, other precious metals, gold, futures, real estate, currency, and even agricultural products such as red beans, garlic, and mung beans. During the short ten years from 2001 to 2010, the amount of hot money flowing into my country was very large, with an average of $25 billion per year.

The formation of hot money is due to the globalization of financial markets and the rapid expansion of international investment funds. In addition to making medium and long-term investments, many funds in countries with abundant capital resources also reserve some opportunities for short-term investment of mobile funds in order to seek high returns.

The Main Characteristics of Hot Money

1. High reward and high risk. The pursuit of high returns is the ultimate goal of the flow of hot money in the global financial market. Of course, high returns are often accompanied by high risks, so hot money earns high-risk profits.

2. High liquidity and short-term. Based on a high degree of informatization and high sensitivity, hot money can enter quickly when there is money to be made, and exit immediately when risks increase. It’s very short-term, even ultra-short-term, and can come in and out quickly over the course of a day or a week.

3. Highly informative and sensitive. Hot money is highly sensitive to the economic and financial conditions and trends of a country, a region or the world, exchange rate differences in various financial markets, interest rate differences, and various price differences, as well as economic policies of related countries, and can be quickly reflected.

4. High fictitious and speculative nature of investment. The reason why hot money is a kind of investment funds mainly refers to the fact that they are invested in the global securities market and currency market have a certain lubricating effect on the financial market in order to obtain profits from the price fluctuations of securities and currencies. If there are no risk appetites such as hot money in the financial market, it is impossible for risk aversion to transfer risks. However, hot money investment neither creates jobs nor provides services, and is highly virtual, speculative and destructive.

What are the influences of hot money?

Hot money has an impact on a country and even the global economy. Of course, this kind of influence can be divided into positive and negative, and we must look at this issue objectively.

Positive influence:

1. It plays an important role in the perfection, development and stability of the financial market. The inflow of hot money affirms the investment value of the financial market and provides positive market signals for ordinary investors.

2. The inflow of hot money will make the regulatory authorities realize the weaknesses and deficiencies in the development of the domestic securities market, promote the long-term development of the capital market in a certain sense, and even improve the investment philosophy, knowledge and skills of ordinary investors from a certain perspective.

Negative influence:

1. Once a suitable target is found for these short-term large investment funds, they will enter in large numbers to make their prices rise rapidly. When it reaches the satisfaction point of short-term profit, it will sell and withdraw in large quantities. Therefore, these commodities that have been hyped by hot money often show a phenomenon of skyrocketing and plummeting, which may cause instability in the financial market at least, and cause regional or even global financial turmoil at worst.

2. Increase the instability of the international financial market and easily lead to financial crises. For example, in the Southeast Asian financial crisis that broke out in 1997, under the impact of the international hot money “quantum fund” headed by Soros, Thailand was forced to announce a sharp depreciation of the Thai baht, and abolished the fixed exchange rate system between the Thai baht and the US dollar to implement free floating, which plunged Thailand into a financial crisis.

3. Distort the price of a country’s stock market, fluctuate violently, and be more affected by the international securities market. The frequent inflow and outflow of hot money magnifies the volatility of the stock market and investment risks, which is not conducive to the stable and healthy development of the securities market.

4. Weaken the effectiveness of a country’s monetary policy. The inflow of hot money weakens the independence and initiative of a country’s monetary policy to a certain extent. Hot money inflows are often inconsistent with the direction and goals of monetary policy. What’s more, it poses a challenge to the effectiveness of capital control, and has a negative impact on macroeconomic regulation and control, the expected effect of monetary policy, and sustainability.

5. Hot money can also lead to bubbles. When there are a large number of investors in the market who are investing a lot of money, the price will start to soar, but this is not the real value, but just an illusion of the market. When this goes on, it will lead to a big crash, and a lot of people will be hurt because of it.